The New Era of Financial Intelligence: How AI is Transforming Finance Across Industries

Artificial Intelligence (AI) is no longer a distant concept reserved for tech giants. It’s here - reshaping the way industries like construction, engineering, manufacturing, and higher education manage their financial operations. From forecasting and cost control to strategic planning and decision-making, AI’s role in

Generative AI Agents: The New Productivity Engine for Finance Teams

In today’s fast-moving business landscape, financial leaders are under pressure to do more with less - faster, smarter, and with greater accuracy. Enter Generative AI agents: intelligent digital assistants powered by artificial intelligence that can analyze data, automate repetitive tasks, and even generate strategic

AI in Forecasting: Moving Beyond Historical Data to Predict the Future of Finance

Forecasting has always been at the heart of finance. Traditionally, predictions relied heavily on historical data and rigid models. But in a volatile economy, history isn’t always the best predictor. AI changes the game by using machine learning, real-time data, and advanced algorithms to

From Spreadsheets to Smart Systems: How AI is Transforming Financial Planning & Analysis

For decades, spreadsheets have been the backbone of financial planning and analysis (FP&A). While useful, they are prone to errors, time-consuming to maintain, and offer limited forecasting ability. Today, Artificial Intelligence (AI) is replacing static spreadsheets with dynamic, intelligent systems that empower finance teams

Getting Started with AI and Integrated Business Planning (IBP)

Getting Started with AI and Integrated Business Planning (IBP) In today’s dynamic business environment, integrating strategic ambitions with operational execution remains critical. AI-infused Integrated Business Planning (IBP) helps bridge this gap - empowering organizations to be more agile, data-informed, and forward-looking. What Is IBP

The Future of Finance with AI: A Roadmap to Strategic Advantage

The Stakes Have Changed - Have You? As the financial ecosystem accelerates toward digitization, Artificial Intelligence is no longer a tool - it’s a growth engine. For fintech leaders, the opportunity isn’t just about improving efficiency. It’s about transforming the core of financial decision-making,

Choosing Your CPMExpress Implementation Partner: Things to Consider

Things to consider when choosing Your CPM Express Implementation Partner? Making the move from manual processes to a modern Corporate Performance Management (CPM) solution is a big step - but choosing the right partner can make it seamless. Partners should specialize in helping mid-market

Simplifying Finance: Key Features of CPM Express

Simplifying Finance: Key Features of CPM Express For finance teams looking to modernize without overhauling everything they know, CPM Express offers a practical, scalable solution. Built on the OneStream platform, CPM Express combines speed, simplicity, and power-making it easier for organizations to get started

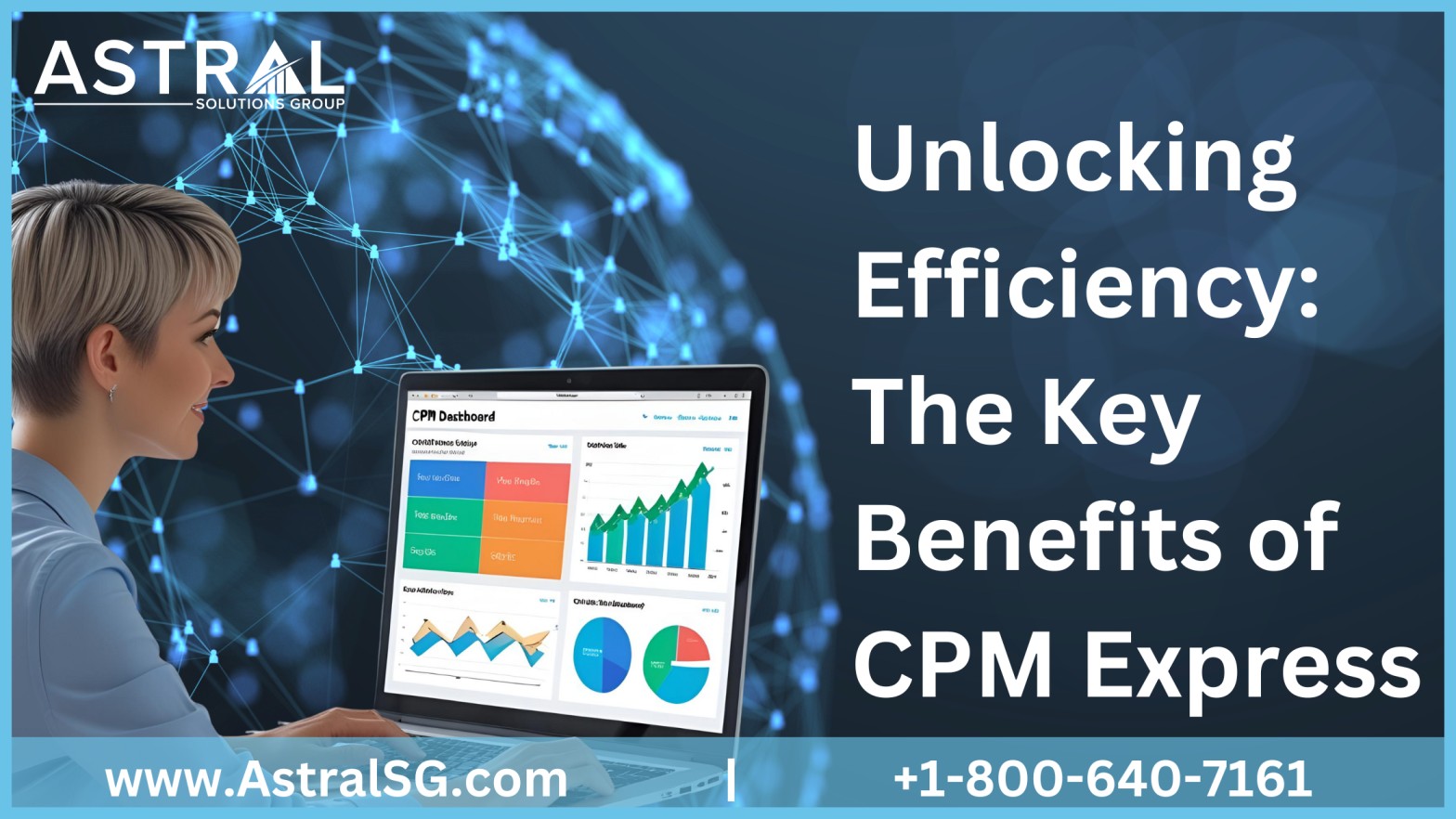

Unlocking Efficiency: The Key Benefits of CPM Express

In today’s dynamic business landscape, finance teams are under pressure to do more with less—faster. Manual spreadsheets and siloed systems can no longer keep up with the speed and complexity of modern financial processes. That’s where CPM Express comes in. CPM Express, developed by

Unlocking Value with Integrated Business Planning (IBP) in Finance

Traditional financial planning methods often fall short in today's volatile business environment. Market disruptions, fluctuating consumer demands, and global supply chain uncertainties require a more dynamic, collaborative, and data-driven approach. Integrated Business Planning (IBP) is a game-changer, particularly for finance leaders. IBP aligns strategic,

Building a Resilient Finance Function in an Era of Constant Change

In today’s volatile business landscape, finance functions are constantly pressured to evolve. With rapid technological advancements, economic uncertainty, regulatory shifts, and rising stakeholder expectations, building a resilient finance function is no longer a choice—it's a necessity. A resilient finance team can withstand disruptions, adapt

How Multi-Entity Organizations Can Streamline Financial Consolidation

How Multi-Entity Organizations Can Streamline Financial Consolidation Financial consolidation is one of the most complex and critical tasks for multi-entity organizations—those operating across subsidiaries, regions, or business units. Coordinating financial data from diverse systems, currencies, regulations, and accounting standards can be time-consuming and error-prone.

The Role of Data Governance in Financial Consolidation

The Role of Data Governance in Financial Consolidation Financial consolidation is a strategic necessity in today's increasingly data-driven company environment, not merely a requirement for monthly or quarterly reporting. Combining financial data from several subsidiaries or business units becomes more difficult as companies develop,

Why CFOs Are Prioritizing Continuous Accounting

The fast-paced, data-driven business world of today makes traditional accounting techniques obsolete. Agile financial operations and real-time information are replacing monthly or quarterly closes. Continuous accounting is a cutting-edge strategy that progressive CFOs are adopting quickly. Let's examine continuous accounting's definition, significance, and the

Implementing Lean Principles in Financial Management

Implementing Lean Principles in Financial Management In today's competitive business environment, organizations strive for efficiency, cost reduction, and enhanced value creation. Initially developed in manufacturing, Lean principles are widely applied in various business functions, including financial management. By incorporating Lean methodologies, finance teams can