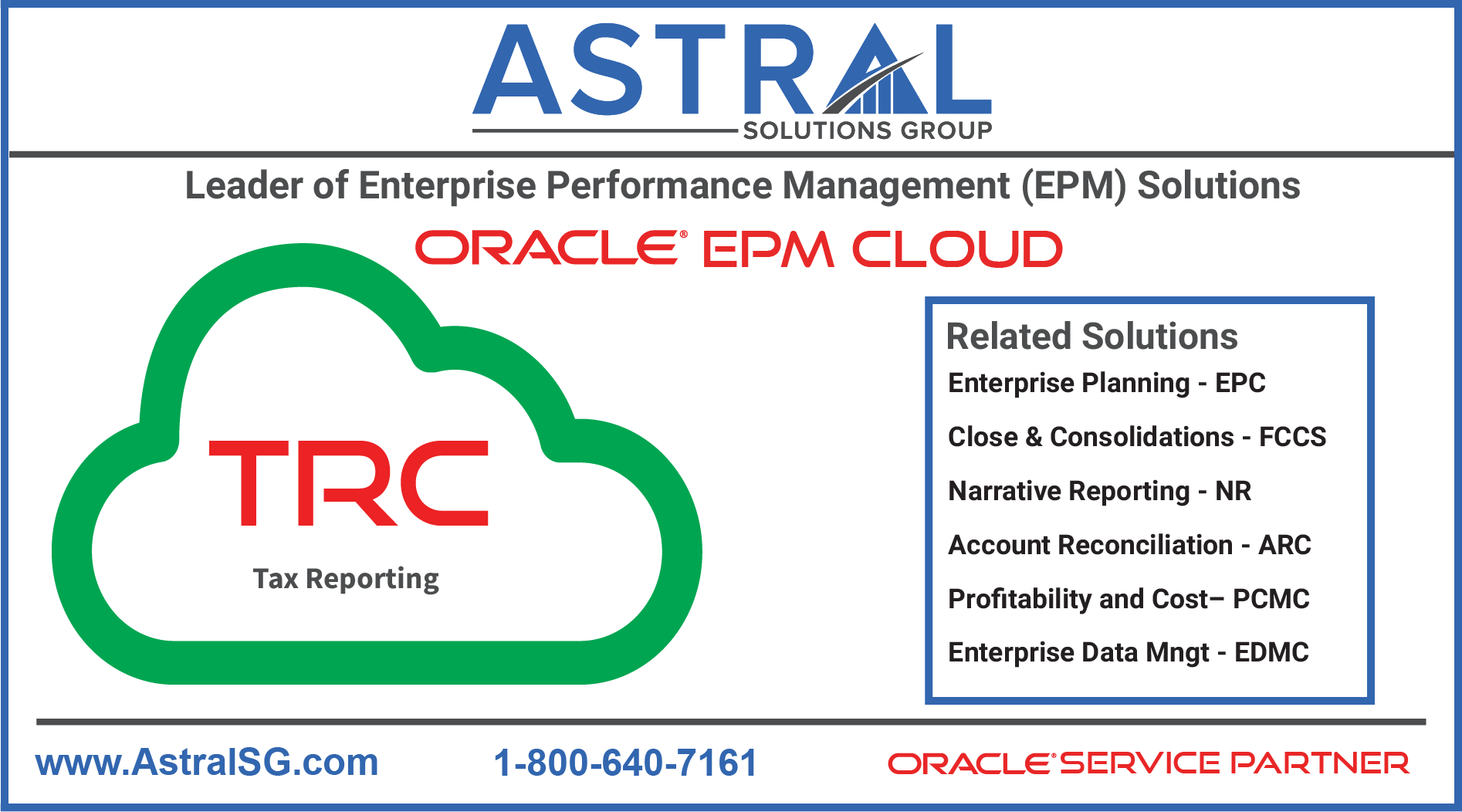

Tax Reporting(TRC) in Oracle Cloud EPM: A Comprehensive Solution for Efficient and Accurate Tax Compliance

Introduction:

Tax reporting is a crucial aspect of financial management for businesses across the globe. It entails gathering, computing, and submitting tax-related data to meet regulatory obligations. As a result, businesses are increasingly using cloud-based solutions in the digital age to automate and verify the correctness of their tax reporting procedures. Tax reporting in Oracle Cloud EPM (Enterprise Performance Management) is one such solution. This article investigates the deployment of tax reporting in Oracle Cloud EPM, explores its essential features, discusses them, and identifies the important advantages it gives enterprises.

What is Tax Reporting?

Tax reporting is the process of gathering and presenting financial data to tax authorities in order to comply with tax laws. It includes figuring out tax obligations, disclosing taxable income, and submitting tax returns. Tax reporting is crucial for businesses to accurately and promptly complete their tax duties.

Tax Reporting in Oracle Cloud EPM:

A strong cloud-based platform called Oracle Cloud EPM provides a full range of financial planning, budgeting, and reporting tools. In addition, Oracle offers a specific tax reporting module as part of this package, allowing companies to manage their tax compliance procedures efficiently.

Tax Provision and Country-by-Country Reporting:

A company’s existing and upcoming tax liabilities are estimated and reported in a tax provision. For the purposes of financial reporting, it entails computing the income tax expense or benefit. Businesses can precisely estimate their tax liabilities and adhere to financial reporting rules thanks to integrating tax provision capabilities into the tax reporting module in Oracle Cloud EPM.

A particular kind of tax reporting required by tax authorities in some jurisdictions is “country-by-country reporting” (CbCR). Multinational corporations (MNEs) are required to publish comprehensive information on how they allocate their profits globally, the taxes they pay, and other important economic activity indicators. With capabilities that make country-by-country reporting easier, Oracle Cloud EPM enables MNEs to quickly gather, aggregate, and report the necessary data across many jurisdictions.

- Tax Automation:

Tax-related operations, calculations, and reporting are automated through technology and software. Strong tax automation features provided by Oracle Cloud EPM simplify various tax-related procedures. It streamlines human tasks, automates tax calculations, and maintains consistency and accuracy in tax reporting. As a result, businesses may reduce manual errors, conserve time and resources, and improve overall efficiency in tax management by utilizing tax automation in Oracle Cloud EPM. - Tax Data Collection:

Collecting and combining the necessary financial and operational data for tax reporting is known as tax data collection. By interacting with other economic systems, such as ERP software, to retrieve pertinent data, Oracle Cloud EPM streamlines tax data collection. As a result, it does away with the necessity for manual data entry and guarantees the precision and thoroughness of tax-related data. As a result, automating data gathering enables businesses to simplify the tax filing process, reduce errors, and enhance data accuracy. - Tax and Accounting Calculation:

Calculating tax and accounting obligations and benefits in accordance with applicable tax legislation and accounting guidelines. Built-in tax calculations in Oracle Cloud EPM follow the most recent accounting standards and tax laws. The platform also uses pre-established tax formulae and guidelines to guarantee precise tax and accounting calculations. As a result, businesses may save time, increase accuracy, and produce trustworthy financial statements by utilizing Oracle Cloud EPM for tax and accounting calculations. - Reporting and Analysis:

For tax-related reporting and analysis, Oracle Cloud EPM provides comprehensive features. It offers pre-built tax reporting structures and templates that adhere to legal criteria. The platform, therefore, makes it possible for companies to produce thorough tax reports, financial statements, and statutory filings. Additionally, organizations may analyze tax data, undertake variance analysis, and get insight into tax positions thanks to Oracle Cloud EPM’s reporting and analysis functionalities. Thanks to this, businesses may identify opportunities for tax planning, make educated decisions, and optimize their overall tax strategy.

Workflow:

In Oracle Cloud EPM, workflow management is a crucial component of tax reporting. The application offers a centralized workspace for handling tasks, workflows, and paperwork of taxes. It helps organizations specify and automate approval procedures, delegate work to certain individuals or groups, monitor development, and record actions. Workflow functionality ensures deadlines are met, tax reporting processes are streamlined, and coordination across tax departments is made easier. As a result, businesses can better communicate and manage their tax reporting procedures more efficiently.

Key Features of Tax Reporting in Oracle Cloud EPM:

- Tax Provisioning:

By automating calculations, combining data from various sources, and offering pre-built tax computations and reporting templates, Oracle Cloud EPM streamlines the tax provisioning process. It guarantees correct tax provision computations and facilitates the distribution of tax expenses across various business divisions. - Tax Reporting:

Financial statement reporting, statutory reporting, and tax compliance reporting are just a few of the many reporting options available on the platform. It supports numerous tax legislation and forms from different countries. Additionally, Oracle Cloud EPM offers pre-built tax templates and adaptable reporting frameworks, enabling companies to produce precise and thorough tax reports. - Data Integration:

Oracle Cloud EPM seamlessly connects with other financial systems, such as ERP software, to gather and combine tax-related data from diverse sources. As a result, data utilized in tax reporting is accurate and consistent thanks to this connectivity. As a result, by using the platform’s data integration features, firms can do away with manual data entry, lower errors, and increase productivity. - Workflow and Collaboration:

By offering a centralized workspace for handling tax activities, workflows, and paperwork, the platform makes it easier for tax teams to collaborate. For example, it makes it possible for team members to communicate in real-time, monitor development, and keep an audit trail. Oracle Cloud EPM’s workflow management tools also ensure deadlines are fulfilled, and tax reporting processes are automated. - Compliance Management:

For businesses, adhering to tax requirements is of utmost importance. This is made possible by Oracle Cloud EPM’s automatic tax calculations, tracking of tax provisions, and supply of real-time updates on tax laws. As a result, the platform aids in reducing the danger of mistakes and fines related to tax filing. Additionally, it guarantees that companies follow the most recent tax laws and criteria.

Key Benefits of Tax Reporting in Oracle Cloud EPM:

- Enhanced Efficiency:

The Oracle Cloud EPM’s tax provisioning and reporting processes can be automated, significantly minimizing human work and boosting productivity. Instead of focusing on time-consuming and repetitive processes, tax teams may concentrate on activities that create value. In addition, the platform’s automation features simplify and save time and money on the entire tax reporting process. - Improved Accuracy:

The probability of errors in tax reporting is reduced by integrated data aggregation and automated computations in Oracle Cloud EPM. The software uses specified tax laws and formulae to calculate taxes accurately and consistently. As a result, businesses can depend on the platform to produce accurate tax reports because it does not require manual data entry and minimizes human error. - Real-Time Visibility:

Real-time access to tax data is essential for businesses to make wise judgements and efficiently handle tax responsibilities. Oracle Cloud EPM offers extensive dashboards and reporting capabilities that let businesses keep track of their tax positions, run what-if scenarios, and learn more about their tax liabilities. As a result, businesses may proactively manage their tax planning strategies and improve their financial performance thanks to real-time visibility. - Streamlined Collaboration:

Oracle Cloud EPM fosters teamwork among tax teams by offering a centralized platform for controlling workflows and tasks pertaining to taxes. Team members can track progress, share information, and communicate in real-time to ensure seamless collaboration and minimize communication gaps. As a result, the entire tax reporting process is streamlined, efficiency is increased, and bottlenecks are removed. - Regulatory Compliance:

To avoid fines and audits, firms must adhere to tax requirements. Oracle Cloud EPM keeps organizations current on evolving tax rules and regulations, assisting them in maintaining compliance. The software offers accurate tax reports, real-time updates on tax regulations, and automated compliance processes. This lowers the possibility of non-compliance fines and guarantees that companies pay their taxes on time and correctly.

In conclusion, tax reporting in Oracle Cloud EPM offers organizations a complete way to automate their tax compliance procedures. The platform’s major features, including tax provisioning, reporting capabilities, data integration, workflow management, and compliance management, enable businesses to easily and properly manage their tax reporting responsibilities. Tax reporting in Oracle Cloud EPM offers essential advantages such as greater accuracy, real-time visibility, faster cooperation, increased efficiency, and regulatory compliance. Businesses may optimize their financial processes, reduce risks, and guarantee compliance with tax laws using Oracle Cloud EPM for tax reporting.

Contact us and we would love to share our experience with Tax Reporting(TRC) in Oracle Cloud EPM. Please email at info@astralsg.com to learn more about our experience with Tax Reporting in Oracle Cloud EPM.